Anticipated Impact of the Election on Home Sales

As election season approaches, the real estate market anticipates shifts and changes influenced by economic and political factors. Historically, elections have significantly impacted the economy, including housing. Both home buyers and sellers may feel these effects as campaign discussions and polic

Read MoreLooking Ahead: What the Experts Are Saying About Home Prices in 2025

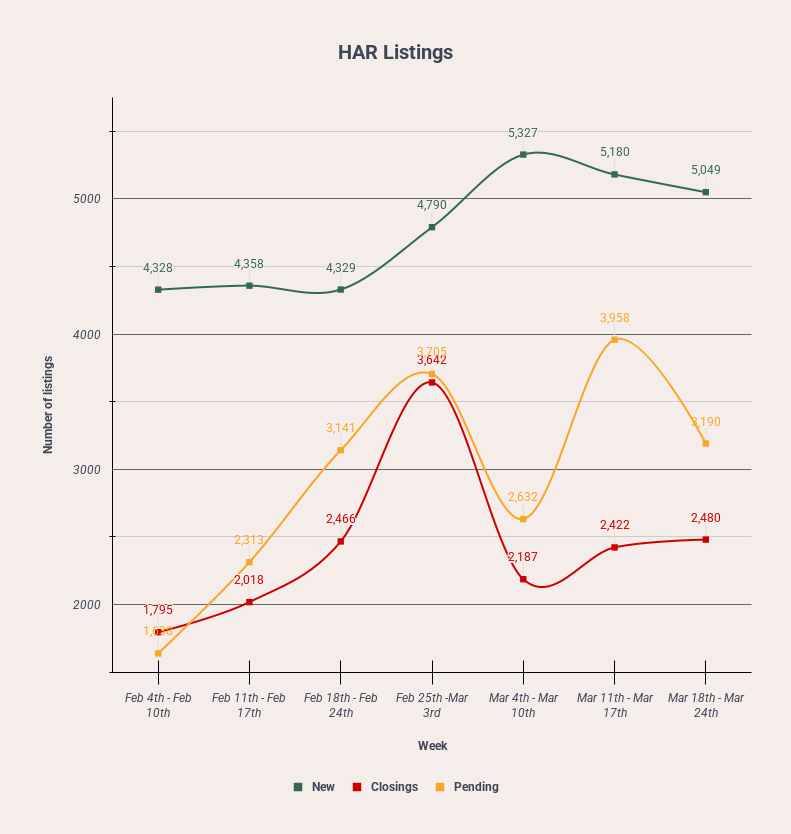

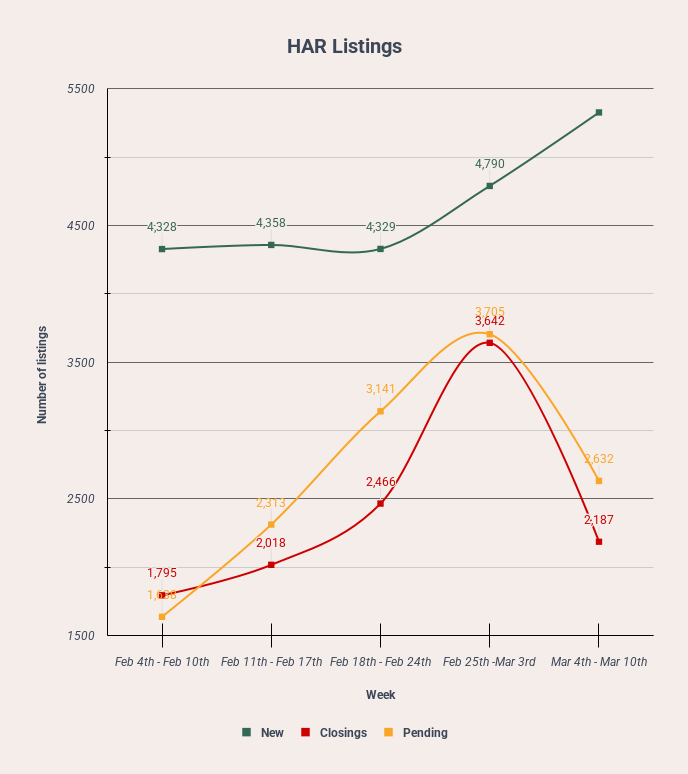

Lately, there's been a lot of buzz about what's next for home prices, especially with 2024 shifting gears in some markets. Here in Houston, median home prices rose by 3.7% during the first six months of 2024 compared to the same period last year. But what about the future of the market? No one has

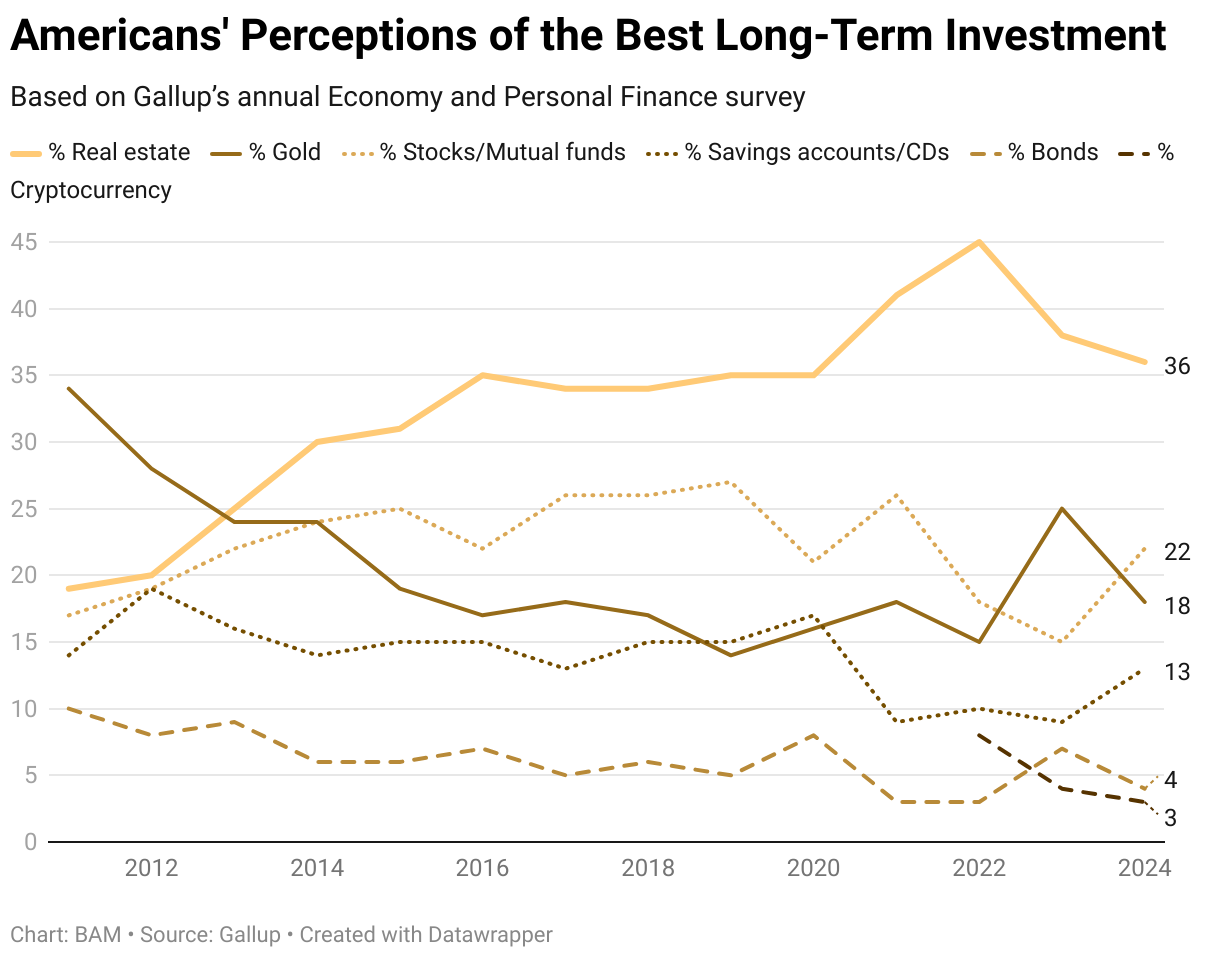

Read MoreReal Estate vs. Stocks: The Ultimate Long-Term Investment Showdown

When it comes to long-term investments, Americans have a clear favorite: real estate. According to a recent Gallup poll, 36% of Americans believe real estate is the best long-term investment, outpacing stocks (22%), gold (18%), savings accounts (13%), bonds (4%) and cryptocurrencies (3%). Why is t

Read MoreMortgage Rate Trends: Exploring the Impact on Buyers, Sellers, and the Market

In the ever-changing world of real estate, staying updated with mortgage rate trends is crucial for both home buyers and sellers. These fluctuations can significantly impact the affordability and availability of homes, shaping the market landscape. As we look ahead to 2024, it is important to unders

Read MoreHow Technology is Revolutionizing Real Estate Marketing in 2024

In today's digital age, technology has significantly impacted various industries, and real estate is no exception. As the market becomes increasingly competitive, real estate professionals are turning to innovative technological solutions to enhance their marketing strategies. From sellers seeking n

Read More-

Home Price Trends in Houston Houston, renowned for its dynamic economy and rich cultural diversity, has been experiencing significant trends in the real estate market. These developments are crucial for both buyers and sellers to understand the current landscape. In this blog post, we'll explore the

Read More

Recent Posts